Effective Rates in Smaller Law Firms

- James Markham

- Mar 13, 2025

- 2 min read

One of the questions left open in The Law Society's Financial Management Survey is that of effective rates, or price achieved by different sized firms

Or at least, a question left open for me, I appreciate it's a niche interest!

In my post earlier this week I noted the correlation between various fee income and profitability measures and firm size (i.e. bigger is better), but couldn't isolate price within that

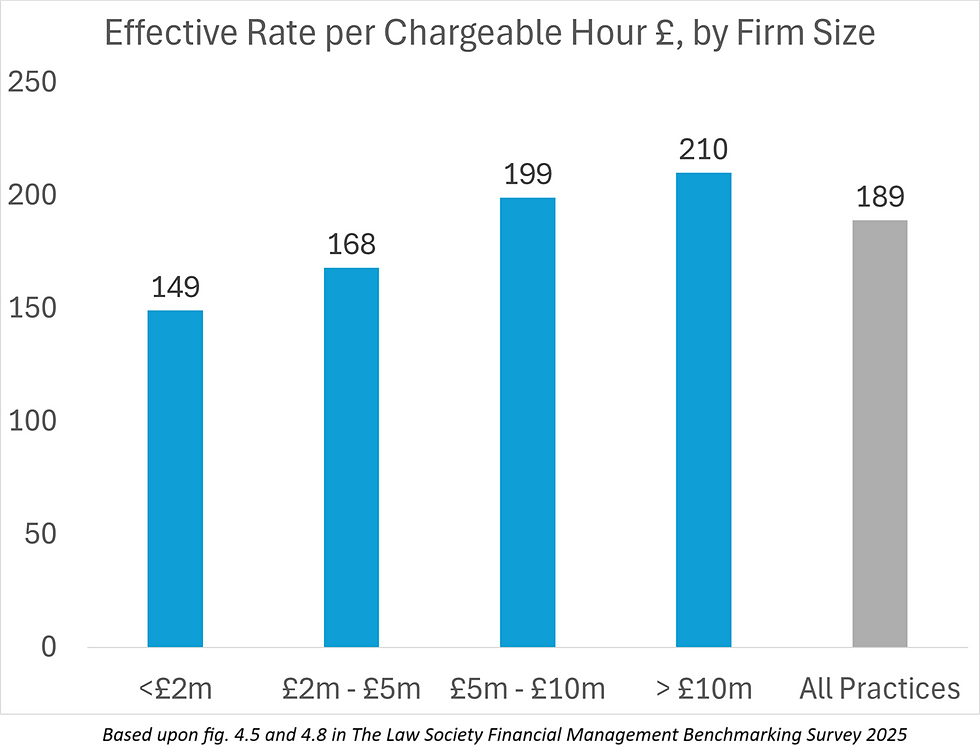

The chart below is based upon the fee income by fee earner (fig. 4.5), divided by the chargeable hours recorded per fee earner (fig. 4.8) numbers reported in the survey

This suggests that effective rate increases with firm size (i.e. the bigger is better theme continues!) and is consistent with the picture painted in PwC's survey of large firms in October 2025

Some caveats and disclaimers:

I've calculated this as a quick and dirty piece of analysis with reference to the summary data in the survey, not the raw underlying data of all survey responses

Almost certainly using the raw response data will produce different results. I suspect it's there or thereabouts for the median data presented here, but I can see that for the lower and upper quartiles the summary data is insufficient

Whilst this analysis indicates a trend, it doesn't speak to what's driving that trend

The report itself speaks to certain factors (e.g. different fee earner utilisation rates) but is silent on others (e.g. mix of fee earner seniority and write-offs between chargeable and billable hours)

All of which is to say, treat with caution and make sure you're unpicking the drivers of fee income (namely, price, volume and mix) before acting on the headlines

Comments